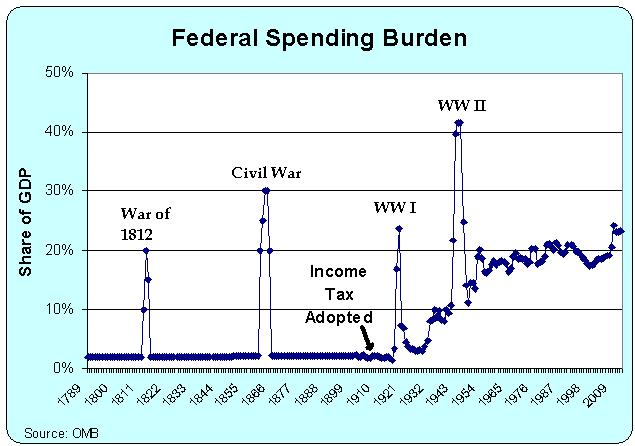

– The month of February (sometimes March) is rarely a happy time in Casa Monomakhos. That is when Goodwife Monomakhova must litter the dining room table with numerous receipts, documents, and assorted detritus in order to make it easier for our accountant to help Uncle Sam swindle us even more. But if you wanted more proof that the National Income Tax is responsible for the growth of the Leviathan State, just look at the first chart. Then read the article.

– The month of February (sometimes March) is rarely a happy time in Casa Monomakhos. That is when Goodwife Monomakhova must litter the dining room table with numerous receipts, documents, and assorted detritus in order to make it easier for our accountant to help Uncle Sam swindle us even more. But if you wanted more proof that the National Income Tax is responsible for the growth of the Leviathan State, just look at the first chart. Then read the article.

The 100th Anniversary of the Income Tax…and the Lesson We Should Learn from that Mistake

Source: International Liberty | By Dan Mitchell

What’s the worst thing about Delaware?

No, not Joe Biden. He’s just a harmless clown and the butt of some good jokes.

Instead, the so-called First State is actually the Worst State because 100 years ago, on this very day, Delaware made the personal income tax possible by ratifying the 16th Amendment.

Though, to be fair, I suppose the 35 states that already had ratified the Amendment were more despicable since they were even more anxious to enable this noxious levy (and Alabama was first in line, which is a further sign that Georgia deserved to win the Southeastern Conference Championship Game, but I digress).

Let’s not get bogged down in details. The purpose of this post is not to re-hash history, but to instead ask what lessons we can learn from the adoption of the income tax.

The most obvious lesson is that politicians can’t be trusted with additional powers. The first income tax had a top tax rate of just 7 percent and the entire tax code was 400 pages long. Now we have a top tax rate of 39.6 percent (even higher if you include additional levies for Medicare and Obamacare) and the tax code has become a 72,000-page monstrosity.

But the main lesson I want to discuss today is that giving politicians a new source of money inevitably leads to much higher spending.

Here’s a chart, based on data from the Office of Management and Budget, showing the burden of federal spending since 1789.

Since OMB only provides aggregate spending data for the 1789-1849 and 1850-1900 periods, which would mean completely flat lines on my chart, I took some wild guesses about how much was spent during the War of 1812 and the Civil War in order to make the chart look a bit more realistic.

But that’s not very important. What I want people to notice is that we enjoyed a very tiny federal government for much of our nation’s history. Federal spending would jump during wars, but then it would quickly shrink back to a very modest level – averaging at most 3 percent of economic output.

So what’s the lesson to learn from this data? Well, you’ll notice that the normal pattern of government shrinking back to its proper size after a war came to an end once the income tax was adopted.

In the pre-income tax days, the federal government had to rely on tariffs and excise taxes, and those revenues were incapable of generating much revenue for the government, both because of political resistance (tariffs were quite unpopular in agricultural states) and Laffer Curve reasons (high tariffs and excise taxes led to smuggling and noncompliance).

But once the politicians had a new source of revenue, they couldn’t resist the temptation to grab more money. And then we got a ratchet effect, with government growing during wartime, but then never shrinking back to its pre-war level once hostilities ended (Robert Higgs wrote a book about this unfortunate phenomenon).

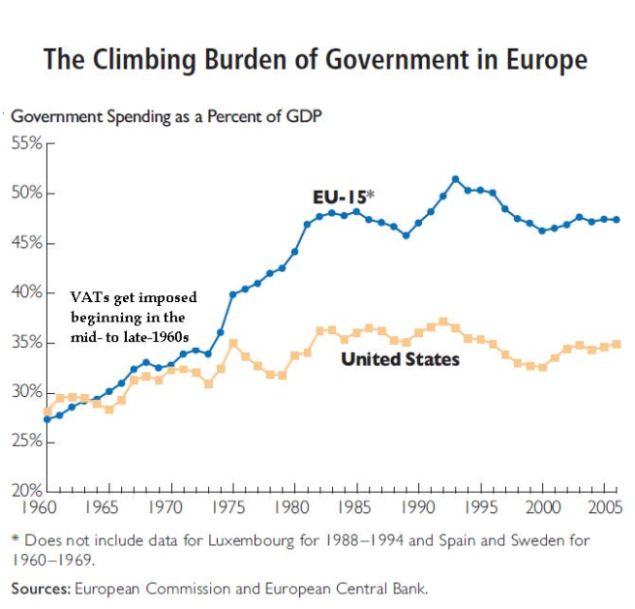

The same thing happened in Europe. The burden of government spending used to be quite modest on the other side of the Atlantic, with outlays consuming only about 10 percent of economic output.

Once European politicians got the income tax, however, that also enabled a big increase is the size of the state.

But Europe also gives us a very good warning about the dangers of giving politicians a second major source of revenue.

Here’s a chart I prepared for a study published when I was at the Heritage Foundation. You’ll notice from 1960-1970 that the overall burden of government spending in Europe was not that different than it was in the United States.

That’s about the time, however, that the European governments began to impose value-added taxes.

The rest, as they say, is history.

I’m not claiming, by the way, that the VAT is the only reason why the burden of government spending expanded in Europe. The Europeans also impose harsher payroll taxes and higher energy taxes. And their income taxes tend to be much more onerous for middle-income households.

But I am arguing that the VAT helped enable bigger government in Europe, just like the income tax decades earlier also enabled bigger government in both Europe and the United States.

So ask yourself a simple question: If we allow politicians in Washington to impose a VAT on top of the income tax, do you think they’ll use the money to expand the size and scope of government?

If it takes more than three seconds to answer that question, I suggest you emigrate to France as quickly as possible.

P.S. You probably won’t be surprised to learn that the crazy bureaucrats at the Paris-based OECD think the VAT is good for growth and jobs. Sort of makes you wonder why we’re subsidizing those statists with American tax dollars.

I think if you go to World Bank records, you can find a lot more recent figures than the above

one reason to get rid of income tax alone = 1100+ pages tax code

another reason – inequity – heavier burden on the poor

another reason – less and less services per federal dollar

another reason – multiple levels of taxation hide actual tax rate

I’m all for paying for national defense, but not for national aggression.

Also, question: since manufacturing has moved off our shores, is an excise tax going to be useful?

As I was driving to the doctor yesterday, I heard on NPR that “many countries” – though unspecified – simply send out a yearly “taxation bill” they have already calculated based on your income. Apparently the “fairness” is per-determined, citizens pay, they move on. They went on to say that such a plan was was first seriously proposed in the US (you’ll never guess) by Ronald Regan, first in CA, and then as president, as eminently money saving by eliminating layer-upon-layer of tax bureaucracy, law, and so on, specifically for those who had no need to itemize, who were using the EZ-forms anyway, who were simply waiting around for W-2’s to file, and could still opt out if they wished. And who were the biggest opponents of Mr. Regans’s plan? Not surprising, 2-5 were advocacy groups concerned that individuals who might be entitled to further and/or more complicated, even esoteric/obscure deductions, would receive a pre-completed form, sign it and send it without seeking advice. I thought, while not unreasonable, realistically, how many people would actually be affected, and even given the option to opt out and seek advice, how many would avail themselves? How many do now? And who constituted, far and away, the number one opposition to this legislation, even to this day: Intuit Corporation, makers of TurboTax software and on-line income tax preparation services. Sure, you can use their on-line EZ-form tax filing preparation and filing service for free if you are below certain income thresholds, but it does nothing to reduce the burden on government.

Metropolitan Jonah‘s Spiritual Studies have resumed (last Monday, sorry for not posting) and will be at St. John the Baptist Cathedral in Washington, D.C. on Mondays at 7 P.M. for a while to accommodate Friday Presanctified Liturgies with Potluck in the Library in the Parish Hall upstairs.

Also, the annual liturgy for the repose of Bishop Basil Rodzianko for family, and friends – come one, come all – will be held this year at St. John the Baptist Cathedral:

Dear Brothers & Sisters,

Parishioner Andrey Skurikhin is back from vacation and has downloaded the following four videos:

March 17, 2013. The Commemoration of the Exile of Adam from Paradise.

Sermon by Metropolitan Jonah:

http://www.youtube.com/embed/wk_k8gKYMfo” frameborder=”0″ allowfullscreen>

March 24, 2013. The Sunday of Orthodoxy.

Sermon by Priest John Johnson:

Sermon by Archpriest Victor Potapov:

http://www.youtube.com/embed/0nKTC_bet6w

March 25, 2013. Orthodox Studies with Metropolitan Jonah (Paffhausen) (starts with a discussion of St. Luke of Simferopol by Father Victor – about which http://orthodoxwiki.org/Luke_%28Voino-Yasenetsky%29_of_Simferopol_and_Crimea ):

http://www.youtube.com/embed/iqh5YWbSqLk

In XC,

Fr. Victor

(*)Anasta/sios), emperor of CONSTANTINOPLE, surnamed Dicorus (Δίκορος) on account of the different colour of his eye-balls, was born about 430 A. D., at Dyrrachium in Epeirus. He was descended from an unknown family, and we are acquainted with only a few circumstances concerning his life previously to his accession. We know, however, that he was a zealous Eutychian, that he was not married, and that he served in the imperial lifeguard of the Silentiarii, which was the cause of his being generally called Anastasius Silentiarius. The emperor Zeno, the Isaurian, having died in 491 without male issue, it was generally believed that his brother Longinus would succeed him; but in consequence of an intrigue carried on during some time, as it seems, between Anastasius and the empress Ariadne, Anastasius was proclaimed emperor. Shortly afterwards he married Ariadne, but it does not appear that he had had an adulterous intercourse with her during the life of her husband. When Anastasius ascended the throne of the Eastern empire he was a man of at least sixty, but though, notwithstanding his advanced age, he evinced uncommon energy, his reign is one of the most deplorable periods of Byzantine history, disturbed as it was by foreign and intestine wars and by the still greater calamity of religious troubles. Immediately after his accession, Longinus, the brother of Zeno, Longinus Magister Officiorum, and Longinus Selinuntius, rose against him, and being all natives of Isauria, where they had great influence, they made this province the centre of their operations against the imperial troops. This war, which is known in history under the name of the Isaurian war, lasted till 497, and partly till 498, when it was finished to the advantage of the emperor by the captivity and death of the ringleaders of the rebellion. John the Scythian, John the Hunchbacked, and under them Justinus, who became afterwards emperor, distinguished themselves greatly as commanders of the armies of Anastasius. The following years were signalized by a sedition in Constantinople occasioned by disturbances between the factions of the Blue and the Green, by religious troubles which the emperor was able to quell only by his own humiliation, by wars with the Arabs and the Bulgarians, and by earthquakes, famine, and plague. (A. D. 500.) Anastasius tried to relieve his people by abolishing the χρυσάργυρος, a heavy poll-tax which was paid indifferently for men and for domestic animals. Immediately after these calamities, Anastasius was involved in a war with Cabadis, the king of Persia, who destroyed the Byzantine army commanded by Hypacius and Patricius Phrygius, and ravaged Mesopotamia in a dreadful manner. Anastasius purchased peace in 505 by paying 11,000 pounds of gold to the Persians, who, being threatened with an invasion of the Huns, restored to the emperor the provinces which they had overrun. From Asia Anastasius sent his generals to the banks of the Danube, where they fought an unsuccessful but not inglorious campaign against the East-Goths of Italy, and tried, but in vain, to defend the passage of the Danube against the Bulgarians. These indefatigable warriors crossed that river in great numbers, and ravaging the greater part of Thrace, appeared in sight of Constantinople; and no other means were left to the emperor to secure the immediate neighbourhood of his capital but by constructing a fortified wall across the isthmus of Constantinople from the coast of the Propontis to that of the Pontus Euxinus. (A. D. 507.) Some parts of this wall, which in a later period proved useful against the Turks, are still existing. Clovis, king of the Franks, was created consul by Anastasius. Anastasius as mention got rid of a poll tax that caused the poor to sell their kids to prostution. Now some states may have a burden more for the poor but not as bad as early Byzantine times.

The income tax is based on the wherewithall to pay concept.

Someone has to pay the bills of government.

The lord or the serf?

Mr Fall, we are not “serfs” but citizens of a republic. (At least for now.) Taxes are to be paid for by ALL who are citizens and possess the right to vote.