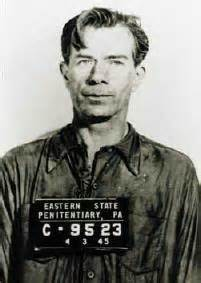

I first heard Sutton’s comment back when I was a teenager. I didn’t understand it until much later. The people asking Sutton this question were no doubt well-meaning Progressives. They were probably interested in his toilet training, whether his mother made him eat his vegetables, if his father paid enough attention to him — something like that. Surely there had to be a reason why he lived a life of crime. It couldn’t be because he was a sinner; after all, Freud proved that there was no such thing!

Instead, Sutton didn’t play along with them. He answered honestly: he robbed banks because he wanted money and he didn’t want to have to work for it. Work is for chumps. It’s really that simple. (It helps if you don’t have a conscience as well.)

Well, good ole’ Willie had nothing on Uncle Sam. Wanna know why Obama lives the uncaring life of an emperor even though he’s doubled our debt to $16 trillion? It’s simple: because there is more than $19 trillion socked away in our 401Ks. You do the math.

And now we see that the EU is freezing the bank accounts of Cypriots in order to confiscate their money. Think it can’t happen here?

Prediction: you’ll be seeing stories in the mainstream press about how it’s our “patriotic duty” to let Uncle Sugar to get his grubby little hands on it; after all, you wouldn’t want the nation to collapse now, would you?

SUCKERS!!!

Source: America Thinker | John White

Quietly, behind the scenes, the groundwork is being laid for federal government confiscation of tax-deferred retirement accounts such as IRAs. Slowly, the cat is being let out of the bag.

Last January 18th, in a little noticed interview of Richard Cordray, acting head of the Consumer Financial Protection Bureau, Bloomberg reported “[t]he U.S. Consumer Financial Protection Bureau [CFPB] is weighing whether it should take on a role in helping Americans manage the $19.4 trillion they have put into retirement savings, a move that would be the agency’s first foray into consumer investments.” That thought generates some skepticism, as aptly expressed by the Richard Terrell cartoon published by American Thinker.Days later On January 24th President Obama renominated Cordray as CFPB director even though his recess appointment was not due to expire until the end of 2013.

One day later, in the first significant resistance to President Obama’s concentration of presidential power, a three judge panel of the U.S. Court of Appeals in Washington DC unanimously said that Obama’s Recess Appointments to the National Labor Relations Board are unconstitutional. Similar litigation testing the Cordray appointment to the CFPB is in the pipeline.

The Consumer Financial Protection Bureau (CFPB) created by the 2,319 page Dodd-Frank legislation is a new and little known bureau with wide-ranging powers. Placed within the Federal Reserve, a corporation privately owned by member banks, the CFPB is insulated from oversight by either the President or Congress, its budget not subject to legislative control. It is not even clear that a new President can replace the CFPB director on taking office.

Unusual legal and political environments have a significant impact on the CFPB. With Cordray’s recess appointment in doubt several questions remain unanswered.

1) What will become of the CFPB when Cordray’s appointment is found invalid? An indicator comes from the NRLB, which operated unconstitutionally for years without a quorum. In 2007 the Senate threatened no NLRB nominations reported out of committee.

The NLRB continued operating with two members. Then a Supreme Court ruling in June of 2010 invalidated the NLRB decisions for lack of a quorum. Fisher & Phillips give the details about what was done next.

But recovery from the Supreme Court’s sting was quick, with Liebman and Schaumber still on the Board and with two new Members confirmed, … the suddenly full-strength Board simply added a new Member to the “rump panel” of the original decisions and managed to rubber-stamp many of the disputed Orders – at a record-setting pace – with the same result…

This may explain why President Obama renominated Cordray a year early. Once confirmed Cordray can rubber-stamp decisions made while he was unconstitutionally appointed. Otherwise those decisions will be invalidated.

2) What will the CFPB do with your money? The CFPB incursion into individual personal savings, in order to control how you invest your money, isn’t a new idea. Current proposals grew from a policy analysis as disclosed by Roger Hedgecock .

On Nov. 20, 2007, Theresa Ghilarducci, professor of economic policy analysis at the New School for Social Research in New York, presented a paper proposing that the feds eliminate the tax deferral for private retirement accounts, confiscate the balance of those accounts, give each worker a $600 annual “contribution,” assess a mandatory savings tax on every worker and guarantee a 3 percent rate of return on the newly titled “Guaranteed Retirement Accounts,” or GRAs.

How would that be accomplished? The Carolina Journal reported Ghilarducci’s 2008 testimony to Nancy Pelosi’s House.

Democrats in the U.S. House have been conducting hearings on proposals to confiscate workers’ personal retirement accounts “including 401(k)s and IRAs” and convert them to accounts managed by the Social Security Administration.

Your Government universal GRA investment savings account is an annuity managed by Social Security. Hedgecock noted ‘[m]ake no mistake here: Obama is after your retirement money. The “annuities” will “invest” not in the familiar packages of bond and stock mutual funds but in the Treasury debt!’

By 2010 Bloomberg published an article titled “US Government Takes Two More Steps Toward Nationalization of Private Retirement Account Assets.” In that article Patrick Heller observed that, with Democrat control of Congress and the Presidency:

[I]n mid-September 2010 the Departments of Labor and Treasury held hearings on the next step toward achieving Ghilarducci’s goals. The stated purpose was to require all private plans to offer retirees an option to elect an annuity. The “behind-the-scenes” purpose for this step was to get people used to the idea that the retirement assets they had accumulated would no longer be part of their estate when they died.

So the Government would get the money, not the estate or family of the people who saved the money during a lifetime of work. That’s a one hundred percent death tax on savings. Worse, the most responsible and poorest families will be penalized.

Democrats had a blueprint for diverting people’s savings from private investment to government debt. Then in 2010 the Tea Party won the house…

3) Why should the Government intervene in people’s savings decisions? The justifications for Government intervention in private financial decisions are varied. Panic over the economy, Wall Street, mandating savings equity, eliminating investment risk, financial crisis losses, retirement security, much-needed oversight, your 401K becomes a 201K, shoddy financial products, and predatory investment bankers are just a few.

If the financial industry is so predatory, how is it possible that savers keep any money? More importantly, we have all those government agencies, FDIC, FINRA, SEC, Labor Department, Treasury Department, NCUA, Office of Thrift Supervision, FHFA, NCUSIF, Comptroller of the Currency, Office of Foreign Assets Control, Pension Benefit Guaranty Corporation, hundreds of criminal penalties, and state level regulators. Are we admitting the Government is incapable of policing criminal and predatory behavior? Do we have invincible predators plundering the people, or do politicians Cry Wolf?

And about that crisis in the economy. Former Congressman Barney Frank, one of the authors of Dodd-Frank, admitted to Larry Kudlow that Government was to blame for the housing crisis.

Professor Ghilarducci said “humans often lack the foresight, discipline, and investing skills required to sustain a savings plan.” Professor Ghilarducci tells us that people are flawed, no argument there.

Her solution, substitute Government decisions for the judgment of the millions of people who actually earned and saved the money. She fails to mention the government bureaucrats wielding the power to compel you to comply are themselves imperfect. Which is preferable, one faulty Government solution or millions of individual free choices?

4) Are there other forces pushing Government to confiscate people’s savings? With $16 trillion in debt the short answer is yes. When governments embark on a path of spending money they don’t have, they resort to financial repression. According to Wikipedia :

Financial repression is any of the measures that governments employ to channel funds to themselves, that, in a deregulated market, would go elsewhere. Financial repression can be particularly effective at liquidating debt.

Do we have any evidence that the US Government is pursuing financial repression? Yes we do. Jeff Cox at CNBC . “US and European regulators are essentially forcing banks to buy up their own government’s debt-a move that could end up making the debt crisis even worse, a Citigroup analysis says.”

An Investors Business Daily article, Banks Pressured to Buy Government Debts , notes that “[b]anks can’t say no. They fear the political fallout. So they meekly submit to the government’s dictates.”

Meanwhile the Wall Street Journal reports that “[i]n 2011, the Fed purchased a stunning 61% of Treasury issuance.” Then a CNS News article revealed that “[s]o far this calendar year [2013], the Federal Reserve has bought up more U.S. government debt than the U.S. Treasury has issued.”

5) Is the health of Social Security (SS) a factor? There are several potential measures of when Social Security retirement goes broke. One measure is when FICA tax income doesn’t cover the cost of retirement checks. We have passed that point already. Others say that SS is fine until the lock box runs out of special issue bonds (IOUs).

Even though the SS bonds in the lock box cannot be sold on the open market, the Treasury Department remains under political pressure to honor that obligation by borrowing real cash to redeem the IOUs. At least until the IOUs in the lock box are gone. How long is that? Based on a credible source, Bruce Krasting at Zerohedge suggests not long.

SS consists of two different pieces. The Old Age and Survivors Insurance (OASI) and Disability Insurance (DI). Both entities have their own Trust Funds (TF). OASI has a big TF that will, in theory, allow for SS retirement benefits to be paid for another 15+ years. On the other hand, the DI fund will run completely dry during the 1stQ of 2016.

So Krasting expects the President and Congress will soon be forced to choose between 4 solutions:

1 Increase Income Taxes

2 Increase Payroll Taxes

3 Cut disability benefits by 30%

4 Kick the can down the road and raid the retirement fund to pay for disability shortfalls.

Krasting predicts Congress and Obama will be behind door number four. His credible source is the Congressional Budget Office report Social Security Trust Fund—February 2013 Baseline. In the footnotes it projects a $1 Trillion drain on the retirement fund which currently holds $2.8 Trillion. That’s a loss of approximately one third of the retirement IOUs.

Krasting however omits another possible solution, politicians can raid private retirement savings to put more IOUs in the lock boxes and more real money in the Treasury. Other people’s money is a temptation and $19.4 Trillion is a very large temptation.

Social Security is the largest entitlement program with a trust fund of $2.8 Trillion IOUs, soon to be reduced by another $1 Trillion. Can any politician, addicted to spending, resist that temptation of $19.4 Trillion? That’s real people’s real money that will be spent by Government in exchange for IOUs given to the SS lock box.

Meanwhile newly minted Senator Elizabeth Warren has entered the debate. Conservatives and Republicans have challenged the CFPB in the wake of the unconstitutional recess appointment. Bloomberg speculates that Warren might agree to trim the CFPB powers in a compromise. Bloomberg reported:

“A strong independent consumer agency is good for families and lenders that follow the rules and good for the economy as a whole,” Warren said yesterday in an interview. “I will keep fighting for that.” [snip]

Some observers have suggested that Warren’s original support for a commission-led bureau might mean she would be amenable to compromise on that issue. Warren spokesman Dan Geldon said such speculation is mistaken.

“Senator Warren thinks the single director structure makes sense and that CFPB should continue to be able to operate, like every other banking regulator, without relying on appropriations for its funding,” Geldon said.

Bloomberg also notes that soon “the Senate will have to decide whether to vote to confirm director Richard Cordray in his post, which would make a legal challenge pointless.”

Conservatives and Republicans challenge the surrender of legislative power to the bureau, the concentrated power of a single director, the unconstitutional recess appointments, and the violation of constitutional separation of powers. The Republican position is the constitutional questions and litigation presently underway should be resolved prior to approving a director of CFPB.

The constitutional issues surrounding Dodd — Frank and the CFPB are beyond the space for this article. For those interested in the legal issues, a good synopsis can be found at the Mark Levin Radio Show podcast for February 18th. Mark is an attorney and his Landmark Legal Foundation has argued many cases before the Supreme Court. He can explain complex legal issues in straightforward language.

Nations like Germany and Sweden could learn a thing or two about parent’s rights from, of all places, Russia, which is one of the freest nations in which to homeschool.

“We have complete freedom of home education in Russia, in terms of legality,” Pavel Parfentiev, a family rights advocate in Russia, said.

“The Russian Federation is sort of a champion of human rights in this particular area, so of course I think it is a good example for both Germany and Sweden where home educators are persecuted,” he said.

Among the persecuted, German home-schooler Juergen Dudek has been taken to court every year for the past 10 years by the German Jugendamt, or Youth Office.

“The Youth Office, I used to call it the ‘Gestapo for the Young.’ As soon as they step in, as soon as they get hold of you, you’ve really got problems,” Dudek said.

German homeschooler Dirk Wunderlich and his wife have lost custody of their children, although they are still allowed to live with them. He also told CBN News he expects to be sent to jail, but said he will never stop homeschooling.

“But I’m not afraid of this. I’m only sad for my family. I will go (to jail) laughing. You can do what you want but my children will not go to school,” he said.

???what does homeschooling have to do with the article???

The state wants to control all aspects of our lives, they want our money, they want our children and they’ll try for our souls.

The education lobby in my home state comes out every year demanding more money, the unfunded pension liabilities of the government workers fund (mostly teachers) puts my state in hot water. My state has a clause in its constitution that says the state must adequately fund education. To many of these greedy **** that means every last dime of the state’s tax revenue. It is, after all, “for the children” Bunk!!!!!

The intellecutal founders of the public school movement in this country particularly Horace Mann were dead set on de-Christianizing the culutre and turning children into obedient minions of the state. They’ve pretty much succeeded.

Go through the system and get advanced degrees even if your mind is still intact, you become enslaved to the ridiculous ‘student loans’.

It all fits.

A lot of the Orthodox foucs progarms are not just only feed the poor but they also have job training and interviewing and so forth to try to get people jobs or better jobs so they are less on assistance.

There is a sharp distinction between philanthropy and statist confiscation. Philanthropy is rooted in virtuous choices of a free will, while statist confiscation is rooted in coercion and has no virtue as its foundation. As you point out, Orthodox Christians are and must be involved in charitable efforts. Almsgiving is essential for our spiritual development, and to love treasure more than the pure kingdom of God is perilous to our souls, and the response to many on the last day will be “I never knew you.” Anyone who confuses the kingdom of God with political agendas, whether left or right, has fallen into the trap of loving treasure more than God’s kingdom. If one reads the fathers carefully, the Fathers taught almsgiving not primarily for the benefit to the poor, but primarily because attachment to worldly wealth brings death to our souls. Today, we have a lot of statist redistribution, but precious little virtue. If we follow the teachings of the Fathers, there will be much virtue and the poor will be well cared for, both physically and more importantly, for their worth as persons.

if social security or medicare are “touched” private retirement accounts will be next. You can bet the 1% will have their money stashed somewhere off shore. the more money the workers put into equities, the richer the rich get. Ryan and Paul would just love this

George,

Thank you! Having given up all of those time-wasting and spiritually unprofitable non-Orthodox blogs and news websites for Great Lent, only three days in I have been aching for some libertarian conspiracy material. And then you give me this… quoting ZeroHedge, no less. This is like the caviar exclusion, or going to Red Lobster for all you can eat shrimp. I have to go buy some precious metals now. 😉

Have a blessed Great Lent.

Cyprus is a Western European nation founded with similar values to those on which our nation is founded. If being concerned about confiscation of private property is “time-wasting”, it either means you don’t think it could happen here, or you don’t think it is as depraved and evil as it really is. Given that it is actually happening in Cyprus, it’s pretty clear that it could happen here. Therefore, those who are not alarmed by it must not respect the absolute and inviolable principle of private property that underlies the holy command “thou shalt not steal.”

I’ve always been of the – admittedly cynical – opinion that Roth IRA’s were created in order to encourage savers to allow the government immediate access to tax revenue on savings deposits that would otherwise be tax deferred if placed in a traditional IRA.

Some financial advisers scowl at my refusal to participate in a Roth IRA. Don’t I understand, they advise, that it won’t be taxed later on when I begin my withdrawals?

Yes, my dear adviser, I do understand that according to current law that is true, but what you don’t seem to realize is that a government that needs revenue is not to be trusted with promises pertaining to the future and will pass/change whatever laws are required to continue their insatiable appetite for spending. When they see a large pool of money, especially if it is in hands of “the rich” (read “responsible”), they will find a way to confiscate it under the guise of justice.

Have a good fast! Love to All!

Next Metropolitan Jonah Bible Study is next Monday at 7 PM at St. John the Baptist Russian Orthodox Church, Washington, D.C.

The movement to Monday in Great Lent is to accommodate Friday Presanctified Liturgies in the Library where the studies are recently located.

Forgive me. I don’t disagree with the article. I am afraid it will happen here. I read things like this all the time and then I get all mad and worked up, so I told myself that I am not going to read any of this stuff during Great Lent – I’ll only go to Byztex and occasionally Monomakhos. That fact that after only a few days I missed it so much and George’s article was so satisfying really struck me. Here I am using an Orthodox blog/forum to cheat the fast – what a ridiculous fool I am!

No need to ask for forgiveness. This blog (lest we forget) is also social and political. There is nothing wrong with a Christian bein a polites. “Fear God, honor the king, love your fellow man.” (2 Peter)

“Honour all men. Love the brotherhood. Fear God. Honour the king.”

where the money is

A total collapse of the stock market and a total collapse of IRA monies is not impossible. Gee, when did that happen in recent history? I can remember telling our broker, the stock market is going to collapse and him saying NO WAY. He asked me why and I said, there has never been a time in history when the Fed bank man and the Treasury Secretary met 3 times in 6 weeks. Something bad is abrewing. And I told him the market was going to 8,000, again he said NO WAY, to which I said, I’m being optimistic I think it is 6,000. And he said, hmmm.

Whether the government ought to have a role in too large to fail is a serious discussion. It will most certainly be met with unhappiness by libertarians who are unwilling to accept government has any role in preventing total economic collapse. Oh, uptick rules, what a bother! Lessons anyone?

As to the merger of concepts of funding social security, the only real threat is the removal of the cap which is certainly debatable and a means to manage the unfunded liabilities. Oh, no, unfunded liabilities? Let’s just stop funding them! That is the solution.

If you want something to worry about, worry about institutional investors like WMR and friends that would be like vultures and attack the IRAs themselves via shortselling if afforded the opportunity. The idea he got 40% of the vote ought scare you plenty.

The rest is just foolish bs mean to scare you from any substantive discussion about how to fund something underfunded. The irony is Ron Paul actually recognized unfunded and underfunded liabilities only preferred reversal to 1880 to fix them all.

For Pete’s sake, read the first sentence of the article by White, if it could be any more gripping to a libertarian; it’d need flypaper on it.

Fear, fear, fear, be afraid, the government is out to get you.

Such stupidity abounds that my UPS driver has followed the advise of some whacko gun pundit on the internet suggesting 100 rounds per caliber is the minimum amount any sane man ought have under his bed at home. When he dispensed the details of his 4700 round stash for his AR, I pondered the wisdom of investing $4,500 in copper and lead under the bed. How many rounds could you get out of that thing before a drone flew over your house and stopped the madness?

Get a grip, they have them on the AR if you have no other means than your hand.

Stop Worrying, Cyprus Has Already Happened in America.

well, DUH!!!!

I was just checking the link I posted above and I discovered it wasn’t working.

Here is the corrected link:

http://www.fool.com/investing/general/2013/04/01/stop-worrying-cyprus-has-already-happened-in-ameri.aspx